One of the reasons I haven't been as active writing here at Snapped Shot is because I've been wrapped up watching the slow-motion trainwreck that the world's economy so closely resembles these days.

One of the reasons I haven't been as active writing here at Snapped Shot is because I've been wrapped up watching the slow-motion trainwreck that the world's economy so closely resembles these days.

Like on one recent occasion in May, in which the stock market melted down by over 1,000 points in about ten minutes' time, and then rebounded even more quickly.

The "Flash Crash" as it's been dubbed.

Fingers were pointed by teleprompters and their readers all over the country, and the unscientific consensus of the television networks at the time ended up being that there was some kind of fat-fingered erroneous trade on the market that caused a "slight" hiccup in the system.

Uhh, right...

Thankfully, there are people out there with longer attention spans than our "intellectual" betters in the media—And one such group of people has produced an in-depth analysis of the causes of the flash crash. (courtesy Zero Hedge). The bad news, of course, is that it's a long and tedious read, so if you're short of time, please allow me to summarize the article thusly:

High-frequency trading firms are loading the various stock markets with truly unprecedented amounts of quote orders, and as a result, the entire mechanism for national stock pricing broke.

Quite badly, in fact.

Sadly, the HFT firms that caused the May market meltdown are still operating in a largely-unregulated fashion today, which means that similar events are all but guaranteed in the future.

So why are HFTs such a problem? Aren't computers beneficial to transmitting information more efficiently, including stock and pricing information?

I'll explore this question, and more, down in the boring section beyond the fold!

Yep, there's no doubt about it:—Computers transfer information faster than we've ever been able to do in history.

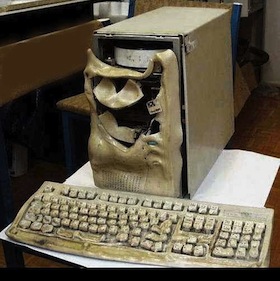

But as we all know, when computers are loaded with buggy programs, the results can be unpredictable (to say the least)—and thus, when one pits multiple groups of buggy computers against each other in a digital fight to the death, it's not surprising when utter chaos appears.

Software bugs don't tend to cancel each other out in real life, after all. They're usually only good at multiplying, yuk yuk.

So what can we do to prevent these firms from nuking the New York Stock Exchange from digital orbit in the future?

Nanex has some really good ideas:—Standardize quote and trade timestamps at the front, in order to allow the computers to detect delays in the system; Ban outright the ability of HFT firms to stuff thousands of quote orders into the exchanges instantaneously, in order to prevent the massive systemic overload we saw on May 6th; and finally, to add a simple quote expiration rule, to allow quote data to be synchronized amongst all of the exchanges, ensuring that the nationwide prices stay in sync.

Or at least, I think that's what they're saying—and I hope I explained it right. I'm still quite rusty with this whole "writing" thing.

Image borrowed from these kind fellows.